Charitable Donation by Will

If you own assets, or have children, you need a will. A will dictates who will be responsible for arranging for payment of your debts and distribution of your assets, who you would like to become guardians of your children, and who should be given your assets after your death.

For tax purposes, on death, you are treated as if you sold all of your assets for their fair market value, so that share in Company A which you bought twenty years ago for $100 that has a value of $1000 on the date of your death will result in a capital gain of $900 to be reported in your final tax return. If you own significant assets (either in value or number) which have increased in value during your lifetime, at your death, your estate may be facing a substantial tax bill.

As in life, charitable donations made at your death (by a gift made in your will) will lead to a tax credit that can generally be used to reduce the tax payable on your final return (subject to certain exceptions). This presents an excellent opportunity to recognize a charity by including a gift to the organization in your will, while reducing your estate’s tax bill.

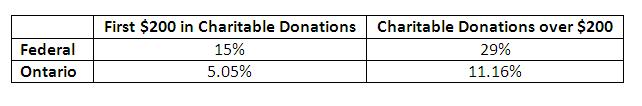

There is both a federal credit and a provincial credit for making a charitable donation, and the credit can be used to directly reduce taxes otherwise payable in your final return. The credit is currently calculated as follows:

What does this mean for your final tax return? Assume that you made a charitable donation of $10,000 in your will, and you were a resident of Ontario at the time of your death. You would be entitled to a combined federal and provincial tax credit of approximately $3,976 which would be applied to reduce any tax otherwise payable. By making a gift in your will you will reduce your overall tax payable and know that your money will go to something you believe in.

There are several ways in which you can make a charitable gift in your will including a gift of a specific amount (ie. $10,000), a gift of a specific percentage (ie. 10% of my estate), a gift of land, a gift of insurance proceeds, or a gift of shares (ie. that share you own in the capital of Company A). This post has focused on a simple gift of either a set amount of money or a set percentage. The implications of making other types of gifts may differ, and will be discussed in future posts.

Written by Dineen Beath.