Canada lags behind in FinTech adoption: EY study

The FinTech industry may be disrupting traditional financial systems around the world, but new research says it’s a little slower to take off in Canada.

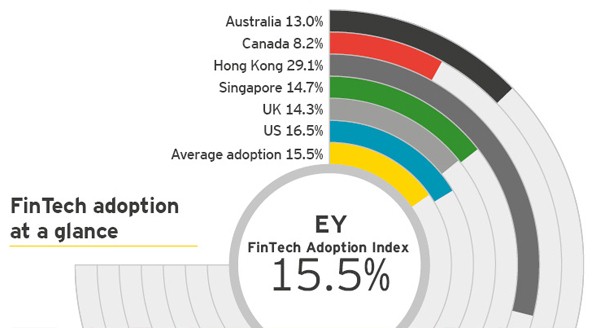

As part of its FinTech Adoption Index, EY surveyed more than 10,000 digitally active people in Canada, Australia, Hong Kong, Singapore, the United Kingdom and the United States to find out their habits.

EY found that 15.5 percent of digitally active consumers have used at least two FinTech products within the last six months. In Canada, however, adoption rates are slower, with just 8.2 percent of digitally active consumers using FinTech products. Of all markets surveyed, Hong Kong had the highest rate of use, at 29.1 percent.

Image: ey.com

The survey noted that FinTech adopters tend to be younger, higher income customers. Overall adoption is concentrated in high-development urban areas like New York, Hong Kong and London. For example, 33.1 percent of New Yorkers have adopted FinTech. In London, more than one-quarter (25.1 percent) have.

What sort of services are taking off? Money transfer and payment services, including foreign exchanges and oversees remittances, are the most popular with 17.6 percent of customers having used these services at least once. Savings and investment services including online stockbroking or rewards crowdfunding, are also popular, with 16.7 percent of users exploring these options. Less popular are insurance services (7.7 percent) and borrowing services (5.6 percent).

For those who have gravitated toward FinTech, they cite seven main reasons namely:

- Easy to set up an account – 43.4%

- More attractive rates/fees – 15.4%

- Access to different products and services – 12.4%

- Better online experience and functionality – 11.2%

- Better quality of service – 10.3%

- More innovative products than available from traditional bank – 5.5%

- Greater level of trust than the traditional institutions – 1.8%

What’s stopping others? EY found that there are six top reasons people don’t use FinTech:

- Was not aware they existed – 53.2%

- Did not have a need to use them – 32.3%

- Prefer to use a traditional financial services provider – 27.7%

- Don’t understand how they work – 21.3%

- Do not trust them – 11.2%

- Have used FinTech in the past but don’t want to use it again – 0.8%

What about you? Are you an early adopter of FinTech or are you holding off?